28+ 30 year vs 20 year mortgage

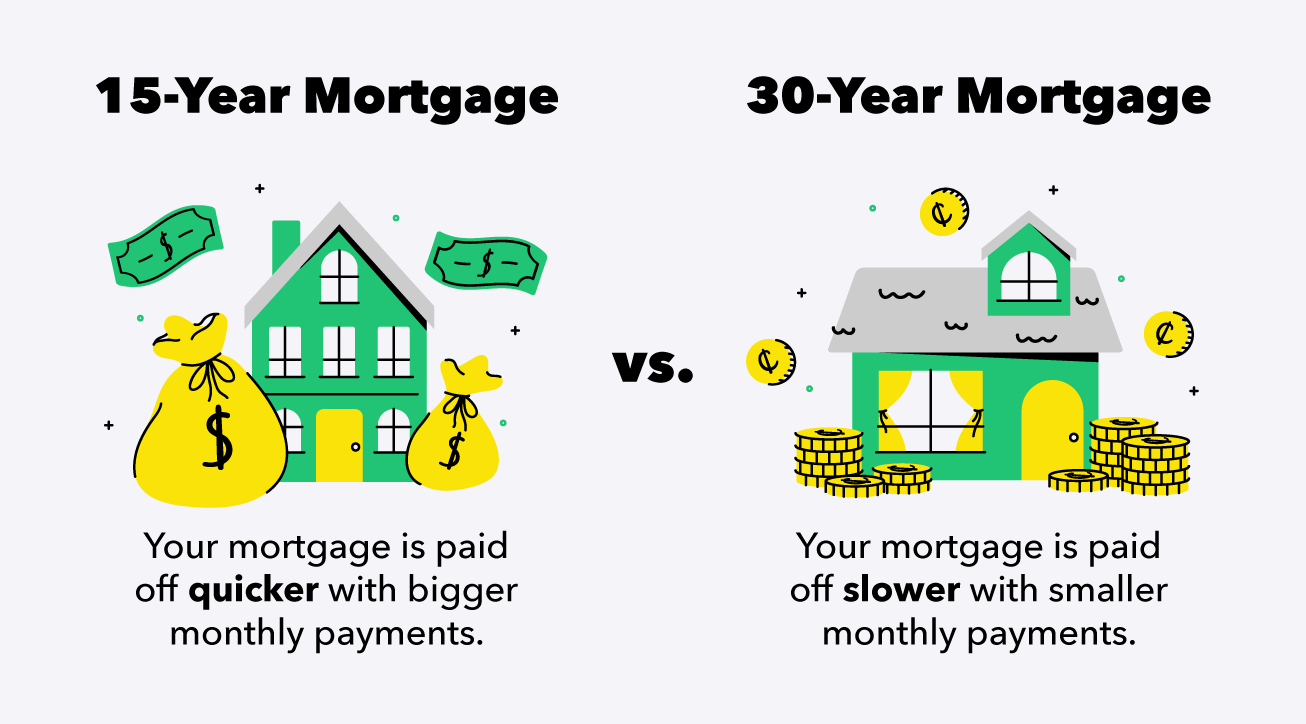

How much lower will vary by banklender and how much you shop around. Repaying a mortgage over 30 years means youll have lower more affordable payments spread out over time compared to shorter-term loans like 15-year mortgages.

The World 12 20 2017

With a shorter 20 year mortgage you will pay significantly less interest than a 30 year mortgage but only if you can afford the higher monthly payment.

. Web A 15-year fixed rate mortgage allows the homebuyer to own their home free and clear in a 15 year period. A 10-year longer repayment term equates to 120 more monthly payments to the lender. SoFi offers fixed-rate mortgages with terms of 10 15 20 and 30 years.

Determining which mortgage term is right for you can be a challenge. Mortgage Rates for Feb. Web Mortgage Comparison Calculator 20 Years vs 30 Years.

Web A 20-year and a 30-year mortgage both offer potential home buyers a relatively long term. Use this calculator to compare the two options and determine which will work best for you. Web While the 30-year option is the most popular option for buying or refinancing homes the 15-year and 20-year options are popular among homeowners looking to lower their rate and pay their home off faster without resetting their remaining loan term to 30 years.

With a 20-year mortgage you can expect a higher monthly payment than with a 30-year home loan but youll pay off your mortgage sooner if. Low down payment options and competitive rates are just some of the advantages of SoFi Home Mortgage Loans. These loans come with lower monthly payments although youll pay more interest during the course of the loan.

Web Say you take out a 200000 mortgage. Web 20-Year Mortgage Rates Are Cheaper. Web Lower monthly payment.

Web With a 20-year mortgage youll pay significantly less interest but have a higher monthly payment. You should receive a lower mortgage rate if you opt for a 20-year fixed mortgage. While the monthly payments are a little higher than a 30-year mortgage the interest rate on the 15-year mortgage is a little lower.

Or you can look at ways to speed things up without. Web A 30-year mortgage is a home loan that lets you repay your lender over 30 yearstypically the longest repayment period a lender will allow and the most popular mortgage product. Web If your budget is fixed a 30-year fixed-rate mortgage is probably the right call.

With a 30-year mortgage youll pay more interest but the monthly payments might be easier to manage. Web If you need lower monthly payments a 30-year mortgage may be the better move. Expect a discount somewhere around 125 to 25 vs.

Web The 20-year mortgage is a solid middle ground between the popular 30-year and 15-year mortgages. With a 30-year mortgage you make loan payments for a longer time. Web Longer repayment period.

Buyers often choose 20-year or 30-year fixed-rate mortgages because of the lower monthly payments and predictability that come with them. Web The 20-year mortgage has several advantages over the 30-year mortgage. Find your rate in minutes.

A 30-year fixed-rate mortgage is by far the most popular for a simple reason. The homebuyer also pays less than half of the total interest of the traditional 30-year mortgage. But be sure to put in the time comparison shopping.

With a 30-year term your loan might come with an interest rate of 32 which means that all in youll end up paying a total of 111534 in interest. Web A 20-year mortgage is designed for you to pay off and own your home outright in 20 years while a 30-year mortgage is designed to do the same in 30 years. Web 20- Vs.

30 years the borrower will likely pay far less in interest over the life of the loan than with a 30-year loan. Web Refinancing a 30-year mortgage to a 10- 15- or 20-year loan allows you to pay off your home faster but requires a higher monthly payment. For one because the term of the loan is 20 years vs.

Lets take a closer look at the similarities and differences between the two loan types. Therefore with each monthly payment youre building equity at a faster rate with a 20-year mortgage than a 30-year mortgage.

15 Year Vs 30 Year Mortgages Which Is Better

Skzssftccpt2um

:max_bytes(150000):strip_icc()/JumboRate_MicroPixieStock-fa53483b03ed44619a0e96b16e2825c4.jpg)

The Best 20 Year Mortgage Rates For 2023

5 Reasons Why A 20 Year Mortgage Is A Great Option Credit Sesame

Home Loans 20 Versus 30 Year Term Finance Advice

20 Year Vs 30 Year Mortgage What Fits You Best Sofi

Sec Filing Crossfirst Bankshares Inc

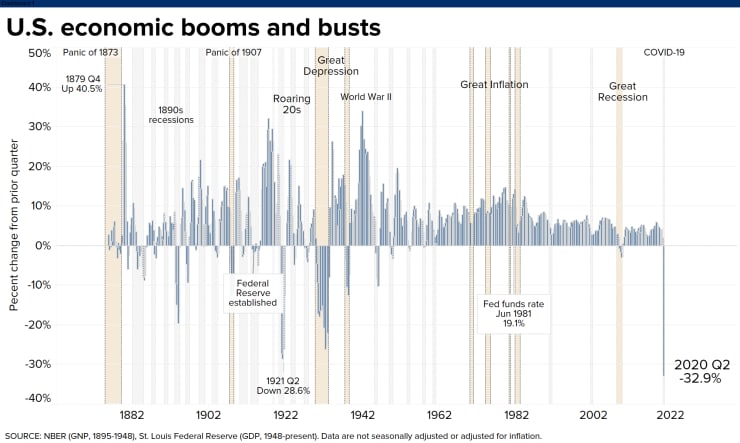

Jeremy Goldfarb Gdp The Largest Drop In History

15 Year Vs 30 Year Mortgages Which Is Better Cnn Underscored

20 Vs 30 Year Mortgage Is An Unusual Option Right For You Credible

15 Year Vs 30 Year Mortgage What S The Difference Ramsey

20 Year Vs 30 Year Mortgage Comparison Rocket Mortgage

20 Vs 30 Year Mortgage Is An Unusual Option Right For You Credible

1 Difference In Mortgage Rate Matter Moneyunder30

Emergency Tools To Help Homeowners With Growing Mortgage Payments Include 40 Year Amortizations R Canadahousing

15 Year Mortgage Loans Vs 30 Year Mortgage Loans Visual Ly

77349 Tx Real Estate Homes For Sale Redfin